| Table of Contents |

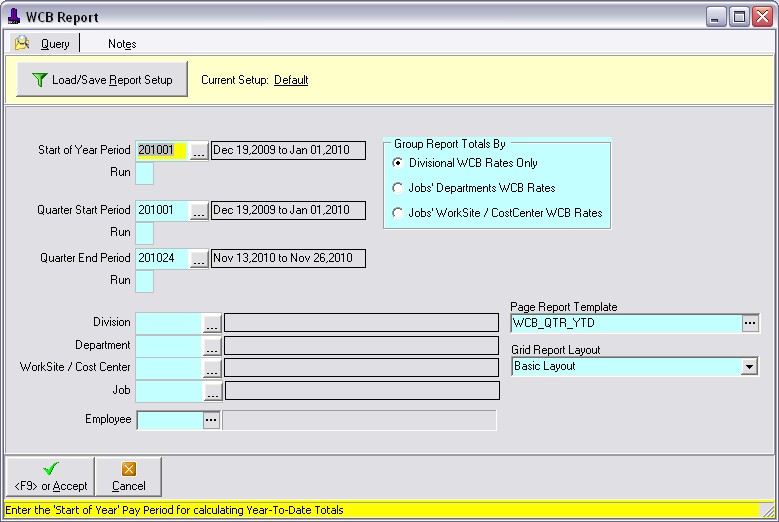

This module produces the WCB report for YTD's and for an entered pay period range (Quarter). It may be viewed as a summary only or showing employee details.

The WCB rates can be set in either the 'WCB Rates Tab' in the Division Maintenance application or via the WCB Rates application usually found on the Pay Tables tab of the main menu.

The following examples show the logic used when creating Batch pay records.| a. | Employee's Current WCB Earnings $ | 2,500.00 | |

| YTD WCB Earnings $ | 25,000.00 | ||

| Total WCB Earnings $ | 30,000.00 | <-- No excess | |

| Calc Prem on all WCB Earnings $ | 2,500.00 | ||

| WCB Premium $ | 75.00 | ||

| b. | Employee's Current WCB Earnings $ | 2,500.00 | |

| YTD WCB Earnings $ | 69,000.00 | ||

| Total WCB Earnings $ | 71,500.00 | ||

| Yearly Max WCB Earnings $ | 70,000.00 | ||

| Excess $ | 1,500.00 | ||

| Calc Prem on adjusted Earnings $ | 1,000.00 | (2,500.00 - 1,500.00) | |

| WCB Premium $ | 30.00 |

| a. | 2,500.00 X 3% = $ | 75.00 | |

| Pay Record WCB Earnings $ | 2,500.00 | ||

| Pay Record WCB Premium $ | 75.00 | ||

| b. | 1,500.00 X 3% = $ | 30.00 | |

| Pay Record WCB Earnings $ | 1,000.00 | ||

| Pay Record WCB Premium $ | 30.00 |

| a. | 2,500.00 + 25,000.00 = YTD Total $ | 30,000.00 |

| b. | 1,000.00 + 69,000.00 = YTD Total $ | 70,000.00 |

| a. | Set Earnings to 2,500.00 and Premium to 75.00 |

| b. | Set Earnings to 1,000.00 and Premium to 30.00 |

The calculation is essentialy the same but can be more detailed depending on how many different Job Dept/Site combinations he/she worked at.

As the employee's earning transactions are being totaled (step 2 above) a list is created for each Dept or Site of the job(s) that the employee worked at.

The Total WCB Earnings is checked for excess each time a record is added to the list and, as the transactions are sorted by date, the latter days may have no WCB Earnings if the employee maxes out on the first days.

A separate record is added to the WCB_VALUES table for each Job Dept/Sitecombination.

Note: As the Pay Record currently has only 1 field to store the rate in then it will be the rate of the 1st transaction totalled.

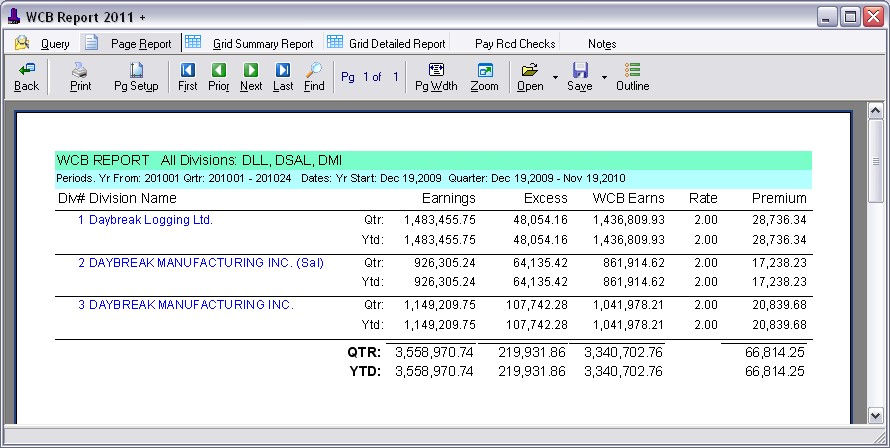

Summary Report

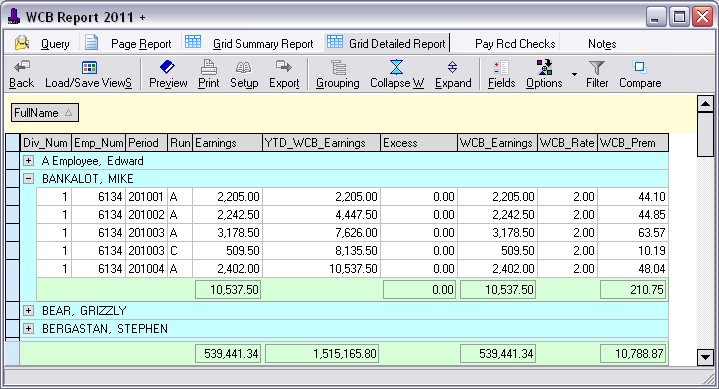

Detailed Report

| Table of Contents | Top |